Zhejiang Merchants Futures' net short position in corn starch has decreased for the third consecutive day!

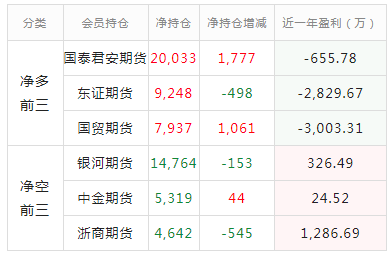

On September 19th, the top 20 corn starch futures companies (total monthly contracts) held 180100 long positions and 186900 short positions, with a long short ratio of 0.96. The net position is -6849 lots, an increase of 3159 lots compared to the previous day.

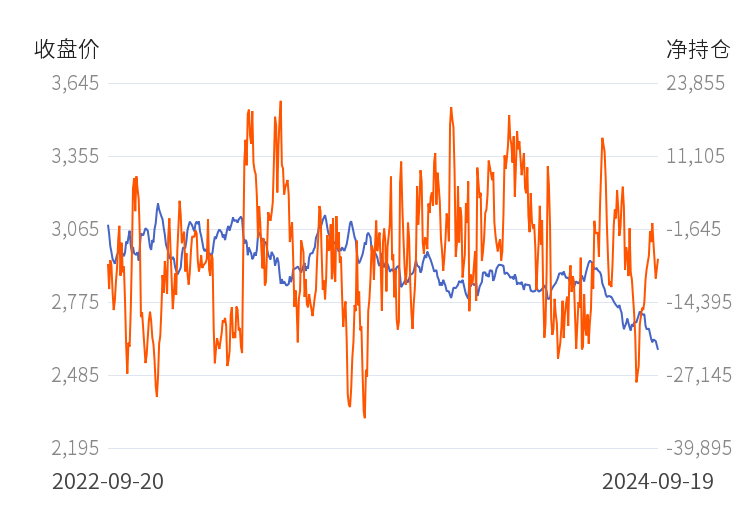

According to statistics, the correlation coefficient between price and net position data in the past two years is -0.29, indicating a weak negative correlation (reversal) between the two.

Trends of Main Contract Institutions for Corn Starch:

From the ranking of net long positions, Guotai Junan Futures ranked first with a net long position of 20000 lots. The net long position increased by 1777 lots during the day, and the company's main contract for the variety had a profit of -6.5578 million yuan in the past year.

In terms of net short position ranking, Galaxy Futures took the top spot with 14800 lots, and the net short position decreased by 153 lots during the day. The company's main contract for the variety has made a profit of 3.2649 million yuan in the past year.

Comparison chart of net holdings and price changes of Zhejiang Merchants Futures

From the previous text, it can be concluded that the institution with the highest profit from corn starch this year is Zhejiang Commodity Futures.

In the past 20 natural days (12 trading days), the net position of Zhejiang Merchants Futures has increased 4 times and decreased 8 times, with a win rate of 75.0% for adjusting positions.

Industry

Industry