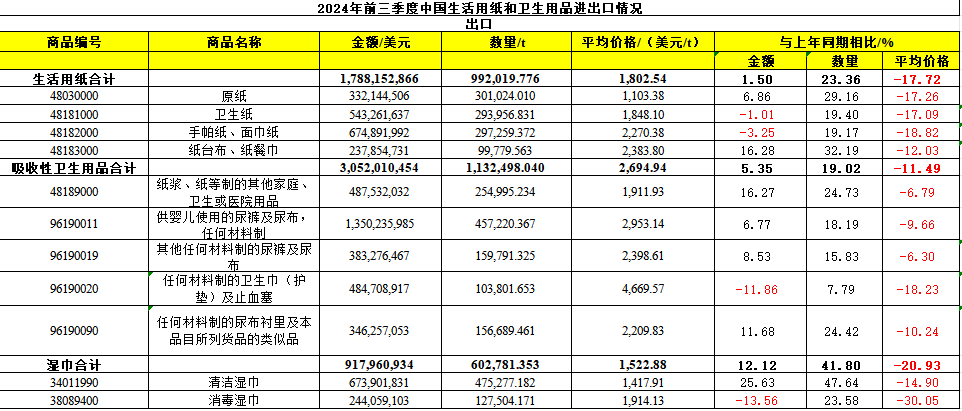

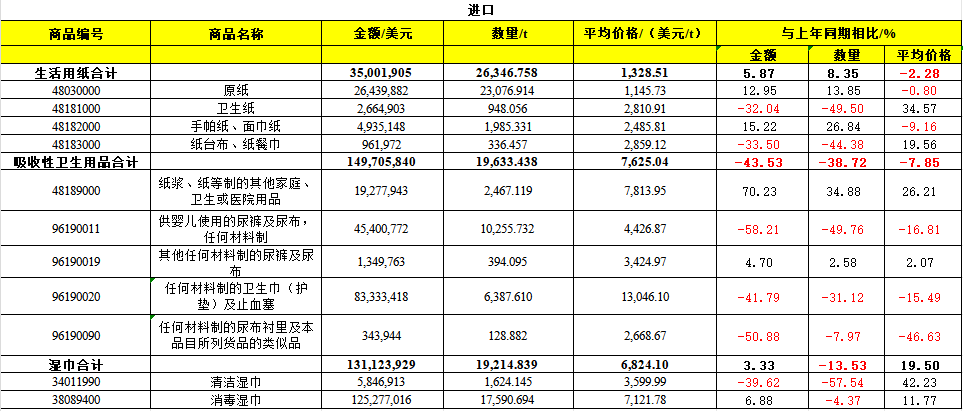

Import and export of household paper and hygiene products in China in the first three quarters of 2024

According to customs statistics, in the first three quarters of 2024, China's household paper products continued to show a trade surplus trend, and the export volume significantly increased. The import volume of absorbent hygiene products and wet wipes continues to decrease, while the export business maintains growth. The specific import and export situation of various products is analyzed as follows:

Living paper

Export

In the first three quarters of 2024, the export volume of household paper increased significantly by 23.36%, reaching 992000 tons, with an export value of 1.788 billion US dollars, a year-on-year increase of 1.50%. The exported household paper is still mainly finished paper (toilet paper, handkerchief paper, facial tissue paper, napkins, etc.), and the export volume of finished paper accounts for 69.7% of the total export volume of household paper products. The average export price of household paper decreased by 17.72% year-on-year, showing a trend of increasing quantity and decreasing price.

Import

In the first three quarters of 2024, the import volume of household paper was very small, only about 26300 tons, slightly increasing compared to the same period last year. The imported household paper was mainly raw paper, accounting for 87.6%. At present, the overall market for household paper in China is dominated by exports, and the domestic production of household paper and product types can already meet the local market demand. The import volume and amount are relatively small, so the impact on the domestic market is minimal.

Absorbent hygiene products

Export

In the first three quarters of 2024, the total export volume of absorbent hygiene products reached 1.1325 million tons, far higher than the import volume, with a year-on-year increase of 19.02%; The export value reached 3.052 billion US dollars, a year-on-year increase of 5.35%, indicating the increasing popularity of Chinese absorbent hygiene products in the international market. The export volume of female hygiene products, baby diapers, and adult incontinence products has increased to varying degrees, but the average export price has decreased. Baby diapers have the largest proportion in the export volume of absorbent hygiene products, accounting for 40.4% of the total export volume.

Import

In the first three quarters of 2024, the import volume of absorbent hygiene products was only 19600 tons, a year-on-year decrease of 38.72%, and the import volume has been continuously decreasing for many years. The imported products are still mainly baby diapers, accounting for 52.2% of the total import volume. However, the import volume of baby diapers has also decreased significantly, with a noticeable decrease compared to 63.7% in the same period of 2023. In recent years, the production capacity and quality improvement of absorbent hygiene products in China have led to a continuous decline in demand for imported products, especially with a decrease in infant birth rates and a reduction in the number of users. The import volume of baby diapers has also decreased significantly.

Wet wipes

Export

In the first three quarters of 2024, the total export volume of wet wipes was 602800 tons, a year-on-year increase of 41.80%. The main export products are cleaning wipes, accounting for approximately 78.8% of the total export volume.

Import

In the first three quarters of 2024, the total import volume of wet wipes was only 19200 tons, a year-on-year decrease of 13.53%. The total export volume of wet wipes is much higher than the total import volume. China's wet wipe production capacity not only meets the domestic market demand, but also has high competitiveness in the international market.

Note: Currently, in the customs commodity code, cleaning wipes are classified under 34011990 and disinfecting wipes are classified under 38089400. However, these two codes not only include wet wipe products, but also other cleaning and disinfecting products.

Industry

Industry