Corn starch may rise first and then fall; pay attention to changes in the trend of raw materials.

Corn is the main raw material for corn starch. This year, the spot price of corn starch, along with that of corn, has been at the lowest level in the same period of the past five years. As of August 7, the price of national standard second-class corn at Jinzhou Port was 2,300 yuan/ton, remaining at the lowest level in the same period of the past five years, a year-on-year decrease of 70 yuan/ton, with a drop of approximately 2.95%. Affected by the downward cost, the price of corn starch this year is also at the lowest level in the same period of the past five years. The mainstream price of national standard first-class corn starch in Shandong is 2,890 yuan/ton, a year-on-year decrease of 50 yuan/ton, with a decline of about 1.70%.

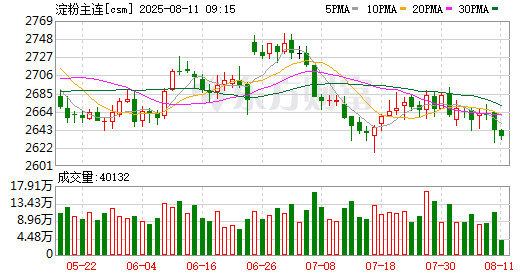

Recently, due to the decline in CBOT corn prices and the unload of stocks by China Grain Reserves Corporation (Sinograin), domestic corn prices have continued to decline. As the volume of grain released by Sinograin gradually decreases, its suppressing effect on corn prices has weakened. Currently, the domestic corn market is in a period where old stocks are depleted and new crops are not yet available. Upstream inventories are lower than the same period last year, imports have dropped significantly year-on-year, and downstream rigid consumption in feed has increased. The spot market is expected to see a reduction in supply and an increase in demand, which will boost prices. However, in the medium to long term, there is a strong expectation of a bumper harvest in domestic and foreign corn-producing regions, which will lead to a continued decline in corn prices. Therefore, affected by the short-term strength and long-term weakness of raw material prices as well as the marginal improvement in demand, it is expected that the price of corn starch will rise first and then fall.

The supply pressure in the corn starch market mainly stems from high inventories. From the supply side, in the first seven months of this year, the inventories of major domestic corn starch enterprises increased by 8.4708 million tons year-on-year, and the inventories at ports in Fujian and Guangdong increased by 37,500 tons year-on-year; during the same period, domestic corn starch output decreased by 830,400 tons year-on-year. Based on the comprehensive calculation of output and changes in enterprise and port inventories, the supply of corn starch during this period increased by 7.6779 million tons year-on-year.

The overall processing profit of the corn starch industry this year is lower than that of the same period in previous years. In representative regions such as Shandong, Hebei, Jilin, and Heilongjiang, the processing profit has been in a state of loss in the past six months and is lower than the same period last year. The poor profit performance has inhibited the production of corn starch.

Judging from the pickup volume of major domestic corn starch enterprises this year, the consumption of corn starch is lower than that of the same period in previous years. In the first seven months of this year, the pickup volume of major domestic corn starch enterprises decreased by 809,400 tons year-on-year. In downstream consumption, starch sugar and paper industries have a large demand for corn starch, but the falling price of tapioca starch, a substitute, has suppressed the consumption of corn starch.

Firstly, summer is the peak consumption season for starch sugar, and the consumption of corn starch by starch sugar is higher than the same period last year, but it is constrained by the reduction in malt syrup consumption. As of the week ending August 1, the domestic starch sugar consumed 73,400 tons of corn starch, an increase of 1,300 tons week-on-week and 3,900 tons year-on-year; in the first seven months of this year, the cumulative consumption of corn starch by domestic starch sugar reached 1.9475 million tons, an increase of 46,200 tons year-on-year. Among them, the cumulative consumption of corn starch by F42 high-fructose corn syrup and F55 high-fructose corn syrup increased by 27,600 tons and 60,600 tons year-on-year respectively. However, due to factors such as insufficient growth momentum in terminal market consumption, the cumulative consumption of corn starch by malt syrup decreased by 42,000 tons year-on-year.

Secondly, the overall operating rate of the paper industry has remained higher than the same period this year. In the first seven months of this year, the average operating rate of corrugated paper was about 59.83%, an increase of 1.37 percentage points year-on-year; the average operating rate of containerboard was about 63.55%, an increase of 2.87 percentage points year-on-year.

Finally, the price advantage of tapioca starch, a substitute, has gradually become prominent, inhibiting the consumption of corn starch. The price difference between tapioca starch and corn starch has dropped to the lowest level in the same period of the past five years. With the approaching of the school season and the double festivals of National Day and Mid-Autumn Festival, market demand for stockpiling will increase, and the pickup volume of corn starch is expected to rise, which will marginally boost its consumption and ease the pressure of enterprise starch inventories. However, due to the low price of substitutes, the expected boost in demand for corn starch is limited.

To sum up, with the arrival of the peak stockpiling season, demand will improve marginally, and the price of corn starch is expected to fluctuate strongly within a range. However, in the medium to long term, as the expectation of a bumper harvest in raw material corn-producing regions is gradually realized, its price will weaken along with the price of raw materials.

Industry

Industry