What will happen to the market in October when CFT's new season corn quickly integrates with the market?

According to the data research department of the feed industry information website Huitong, new corn is sporadically listed in the main production areas of China, and there is still a certain amount of aged grain inventory for sale. Traders are more willing to ship, and coupled with the auctions of China National Grain Reserves Corporation and imported corn, the market has sufficient effective supply, but demand is difficult to meet. Grain consuming enterprises have a clear wait-and-see attitude and maintain a strategy of using and harvesting as needed. Under seasonal pressure, prices have significantly declined, and the national average spot price has fallen by 6.02% month on month.

1、 Supply market - new grains are gradually harvested and launched

The water soaked grain in the Northeast production area has been forced to be harvested early and put on the market. Farmers have a high enthusiasm for selling grain, and some grain holders are under pressure from third-party funds to urgently sell aged grain. Due to the expected reduction in corn storage in the new season, traders are relatively reluctant to sell high-quality grain shipments, while China National Grain Reserves Corporation continues to release, resulting in a slightly loose supply of grain sources in the market. In terms of new works, most corn is in the milk ripening and maturity stages, with Jilin region in the milk ripening stage, and new season corn in Heilongjiang and Liaoning regions also beginning to be harvested and marketed.

The sporadic harvesting and listing of new grain from Northeast China's production areas has cooled down the bullish attitude of trading entities, and the supply of aged grain continues to be listed. The port volume of northern ports is relatively high, and the speed of cargo flow has accelerated. As of the end of the month, the inventory of northern ports totaled 1.5 million tons.

Summer corn in the North China production area has also begun to be listed, with relatively average grain quality and gradually increasing supply of new grain. Traders' enthusiasm for building warehouses is low, and the inventory of trade grain warehouses is higher than the same period in previous years. Traders still have demand for grain production, and surplus grain from grassroots continues to be listed. Due to the impact of heavy rainfall weather, the circulation of corn in some areas is not smooth, and the market shipment speed has slowed down, but the overall supply is still relatively sufficient. In terms of new works, new season corn from Henan, Hebei, Shandong and other places has begun to be launched one after another.

Due to the impact of the typhoon, the supply of shipping schedules in southern ports has tightened, and grain inventories continue to decline. As of the end of this month, the total corn inventory in Shekou Port is about 300000 tons. Traders in the production areas are gradually releasing their inventories, spring corn is gradually being launched, and there is sufficient supply of substitute grains. Reserve aged grains are concentrated in the market, and the supply of grain sources in the southern sales areas is relatively sufficient.

2、 Market demand - enterprises are relatively cautious about stocking up

Some deep processing enterprises in Northeast China have successively started weighing and purchasing Chao grain. The operating rate of deep processing enterprises is gradually recovering, and most processing enterprises have relatively loose inventory, average purchasing enthusiasm, and weak market purchasing and sales. Deep processing enterprises still mainly rely on on-demand procurement, with a large amount of contracted grain and weak willingness to collect bulk grain. The profitability of breeding is poor, and feed enterprises maintain corn inventory for 20-30 days, with procurement still mainly focused on essential needs.

At the beginning of the month, the overall cargo situation at the northern port was still poor, and there was no interest in immediate shipping between the north and south. In addition, the inventory supply was relatively sufficient, and traders reduced their prices to make transactions. However, as the prices at the northern and south ports began to rise in the middle and late of the month, the shipping volume at the northern port was relatively fast.

Traders in the North China production area are cautious about purchasing new corn and have a heavy wait-and-see attitude. The widening price difference between wheat and corn has weakened the support for wheat feed, and the willingness of feed companies to replace corn with wheat has weakened, resulting in a certain demand for corn replenishment. Deep processing enterprises generally adopt a strategy of digesting inventory and have a weak willingness to purchase on demand.

Southern port feed enterprises have a cautious purchasing mentality and maintain rolling replenishment, with an average daily shipment of 13000 tons of domestic corn. The demand for breeding in the sales area is flat, and the procurement pace of feed enterprises is not fast. The inventory of feed enterprises is relatively high, and the atmosphere of corn purchase and sales is light, with more execution of contract orders.

3、 Market situation - spot futures trend: intensified volatility

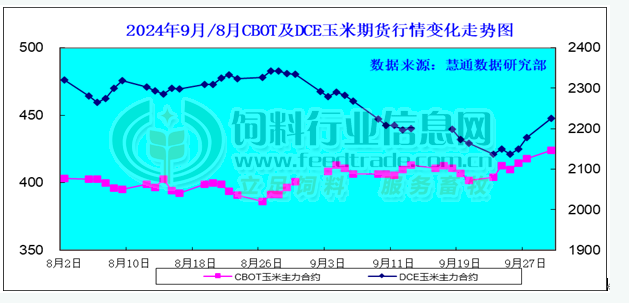

This month's CBOT futures prices have fluctuated and rebounded. As of September 30th, the December contract price has risen by 23.75 cents/bushel compared to a month ago, closing at 424.75 cents/bushel; This month, Dalian corn futures opened high and fell low. As of September 30th, the Dalian corn 2411 contract closed at 2225 yuan/ton, a decrease of 113 yuan/ton from the end of last month.

Chart: Trend Chart of CBOT Corn and DCE Corn Futures Market Changes in September/August 2024 (Unit: cent/bushel, yuan/ton)

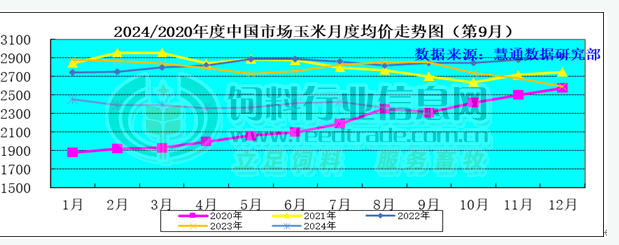

Domestic spot prices have plummeted significantly, with the national average spot price falling by 6.02% month on month.

Chart: Monthly Price Trend of Chinese Corn in September 2024 (Unit: Yuan/ton)

Suggestion:

The supply of aged corn in China will continue to be in a period of shortage, and the overall trend of further tightening supply remains unchanged. In theory, both the supply and demand sides will continue to have positive support for prices. On the other hand, the sales of spring corn in the southern and central regions will continue to increase, and the tight supply of aged corn is expected to ease moderately. The combination of overdue reserves of alternative raw materials such as corn, wheat, and rice will continue to be auctioned and listed, and the supply of imported corn substitutes is generally sufficient. Therefore, the overall situation of sufficient corn supply remains unchanged. It is predicted that during October, corn prices are more likely to remain stable with a slightly weak trend, except for temporary short-term rebound opportunities. Pay close attention to the impact of later weather conditions on the growth and harvesting of corn in the production area.

Industry

Industry