Pay attention to arbitrage opportunities in buying corn and corn starch on the empty market

Part One Abstract

Due to weak domestic corn spot prices but high market premiums, theoretical hedging profits are provided. We analyze the cost of arbitrage between futures and spot prices from the perspective of spot prices. By statistically analyzing the regression time in the past few years and the weak willingness to receive goods in March, we provide recommendations for buying corn with empty 03 or 05 corn.

Part 2: Opportunities for Returning to Corn Stage

1、 Strong expectations, weak reality, and sustained market trend

Corn spot prices are weak. Due to significant losses incurred by traders in 2024, they are still cautious about entering the market. Domestic channel inventory is low, and downstream purchases are still in high demand. Farmers are experiencing losses in planting in the new season and are reluctant to sell. However, after November 24, the temperature has been higher than in previous years, resulting in a higher rate of mold and toxins among farmers. This has led to a decline in the quality of corn this year and a continuous decrease in corn prices. The lowest closing price for corn in Beigang was 2020 yuan/ton, the lowest for corn in central Heilongjiang was below 1850 yuan/ton, and the lowest for corn in central Shandong was below 2000 yuan/ton. From now until the Spring Festival, corn will still experience fluctuations.

Futures have a high premium, and 01 corn has not returned. However, for futures, 05 corn continued to increase its holdings. As of January 8th, the highest position exceeded 1.2 million lots, with a rise of 190 yuan/ton in the market. The main logic behind the high premium in futures is a slight increase in demand after the year, but a significant decrease in feed grains and imports.

The domestic grain supply has significantly decreased. The import volume of domestic grains continues to decline, and it is expected that the import volume will still be relatively low in the first quarter of 2025. In November 2024, a total of 1.75 million tons of corn, sorghum, barley, and DDGS were imported, which is lower than the 5.38 million tons in the same period of 2023. The cumulative import of grains from January to November was 35.31 million tons, which is also lower than the 36.84 million tons in the same period last year. It is expected that the import of grains will continue to decrease before March. Compared with the first quarter of 2024, there will be a significant decrease in brown rice and wheat in China in the first quarter of 2025. Before March 2024, there will still be a large amount of brown rice and wheat not consumed in North China. But currently, the price difference between wheat and corn in North China is around 350 yuan/ton, and wheat substitution is extremely rare. In addition, the 24 year old brown rice has not been auctioned, and the grain supply in the first quarter of 2025 will be significantly reduced.

The demand for corn has increased. Due to the increasing production capacity of deep processing and the good profits of starch enterprises, it is expected that the consumption of deep processed corn will increase by 1-2 million tons. According to data from Steel union, the production of commodity starch in 2024 will be 17.78 million tons, higher than the 15.73 million tons in 2023. It is expected that starch will continue to maintain a slight growth in 2025. In the breeding industry, the profit of pig farming is also good, and it is expected that the pig inventory will continue to increase, resulting in an increase of 2-4 million tons in feed demand. But when other grains decrease, the amount of corn used will increase significantly. According to the latest January report from the National Grain Center, the amount of corn used for feed in the 24/25 fiscal year was 199 million tons, higher than the previous year's 186 million tons, with an increase of 13 million tons in corn used for feed. At the same time, the decrease in corn production in the new season, especially in North China, is about 5.5 million tons (according to data from Steel union).

2、 The market provides hedging profit

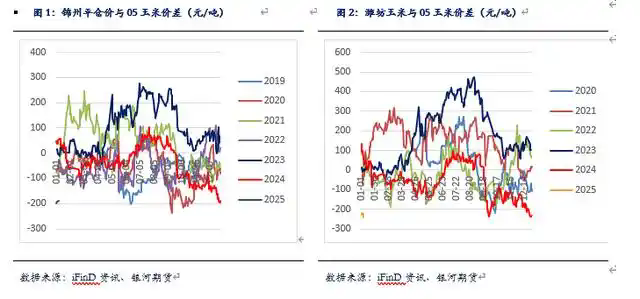

The market also provides theoretical hedging profits. As of January 8th, the closing price of the port is 2040 yuan/ton, with a 03 liter premium of 100 yuan/ton and a 05 liter premium of 190 yuan/ton, both of which have reached new highs in recent years. According to the storage cost plus capital interest of 25 yuan/ton, the storage and capital interest for 5 months is about 125 yuan/ton. Even if a registration warehouse receipt fee of 30-40 yuan is given, the theoretical cost is about 160 yuan. Market 05 provides a delivery profit of 30 yuan/ton, and 03 also provides a delivery profit of 10 yuan/ton. If calculated based on the receiving cost, there will be a delivery fee of 40 yuan/ton for 03. According to statistics from the past few years, the probability of a return in the price difference between futures and cash is relatively high within 5 months of a general market rise. In 2022, the market had a relatively high upward trend, but it returned after June.

Part Three: Buying Spot and Short Market Strategy

Due to the theoretical hedging profit provided by the market, there are a large number of empty positions for buying spot goods, and the warehouse receipts have reached 107000 lots. The market has also increased its holdings to 1.2 million lots. The reason why the warehouse receipts did not return in January is partly due to the high corn market in 1-3 and 1-5, and some companies buying empty warehouse receipts for corn in March.

The corn premiums in 03 and 05 are relatively high, and the market has provided corn hedging profits. Moreover, the market premiums have been maintained for a period of time, and it is expected that the corn prices in 03 and 05 may return. In March, some warehouse receipts had high levels of toxins, and March happened to be the off-season for aquaculture, so the downstream willingness to receive goods was not strong. It is expected that under the pressure of high warehouse receipts in March, there is a high possibility of the return of 03 corn futures and spot prices, which will drive the decline of corn in May, and 05 corn will also return to some extent.

In terms of operation, we suggest that industrial customers can buy spot corn 03 or 05 in order to hedge profits or trade volume. According to one's own operational rhythm, match the time and quantity of empty orders on the 03 and 05 markets.

Industry

Industry